33+ 30 year fixed mortgage calculator

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. But borrowers can also take 10-year 20-year and 25-year.

Kenny Idstein Loandepot

What is a 30-year fixed rate mortgage.

. Totals for year 10 47333 000. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. 15 Year Fixed Rate Mortgage Loan Calculator.

233 Aug 31 2022 83122. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. After a couple of years when borrowers build more income and improve their credit score they have the option to refinance into a shorter term.

The interest rate charged on the outstanding principal balance does not change month to. Disadvantages of 30-year fixed-rate mortgage. Todays mortgage rates in Texas are 5870 for a 30-year fixed 4965 for a 15-year fixed and 5238 for a 5-year adjustable-rate mortgage ARM.

Aside from purchasing a house many buyers use 15-year terms to refinance a 30-year fixed mortgage. By default 250000 30-yr fixed-rate loans are displayed in the table below. This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or commercial lands.

A 30-year fixed rate mortgage is a home loan structure that establishes an unchanging interest rate throughout the course of the loan. Our simple mortgage calculator with taxes and insurance makes it easy to calculate your mortgage payment without the headache of performing the tedious math yourselfor worse guesstimating what the payments might be. For example there are.

How much money could you save. We considered all applicable closing costs including the mortgage tax transfer tax and both fixed and variable fees. Thats about two-thirds of what you borrowed in interest.

10 Year Fixed Rate Mortgage Calculator. You must factor in private mortgage insurance PMI in your expenses. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage.

If you take out a 30-year fixed rate mortgage this means. Well find you. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today.

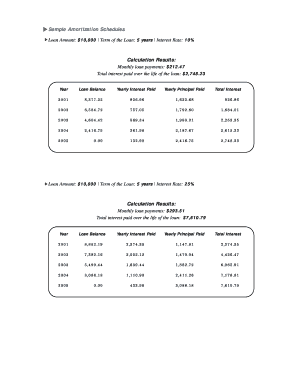

Simple Mortgage Calculator. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan. Conventional loans are commonly offered in 15 and 30-year fixed rate loans.

Assuming you have a 20 down payment 24000 your total mortgage on a 120000 home would be 96000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 431 monthly payment. The spreads change over time but the 15-year is typically about a half a percent lower than the 30-year. While both loan types have similar interest rate profiles the 15-year loan typically offers a lower rate to the 30-year loan.

The 3-year fixed-rate mortgage is a shorter commitment while the 10-year fixed-rate mortgage offers more stability but. Your total interest on a 250000 mortgage. Find average jumbo mortgage rates for the 30 year fixed rate mortgage from Mortgage News Daily.

Because of this many homebuyers take a 30-year fixed-rate mortgage instead. Mortgage Amount Interest. N 30 years x 12 months per year or 360 payments.

Filters enable you to change the loan amount duration or loan type. Making more frequent repayments can also have an impact on your overall monthly repayments. Our Closing Costs study assumed a 30-year fixed-rate mortgage with a 20 down payment on each countys median home value.

Lock-in Redmonds Low 30-Year Mortgage Rates Today. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. This shortens their payment duration while reducing their current rate.

Commonly people select 3 or 10-year fixed-rate mortgages. However you can get a term length ranging from 1 to 10 years. On Sunday September 11th 2022 the average APR on a 30-year fixed-rate mortgage fell 3 basis points to 5976.

Guaranteed Rates 30-Year Mortgage. Getting ready to buy a home. Once we calculated the typical closing costs in each county we divided that figure by the countys median home value to find the.

By choosing a 25-year loan term instead of a 30-year term your monthly repayments would be 267 higher but you would save 38292 in total loan repayments and in total interest paid over the life of the loan. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. A fixed deposit calculator is a tool designed to get an estimate about the maturity amount that the investor should expect at the end of a chosen tenure for a specified deposit amount at the applicable rate of interest.

Warm Up Exercises Find The Slope Of The Line That Passes Through The Points 2 3 2 5 2 Answer 1 0 2 1 3 2 Answer Ppt Download

Pin On Naca Event Locations

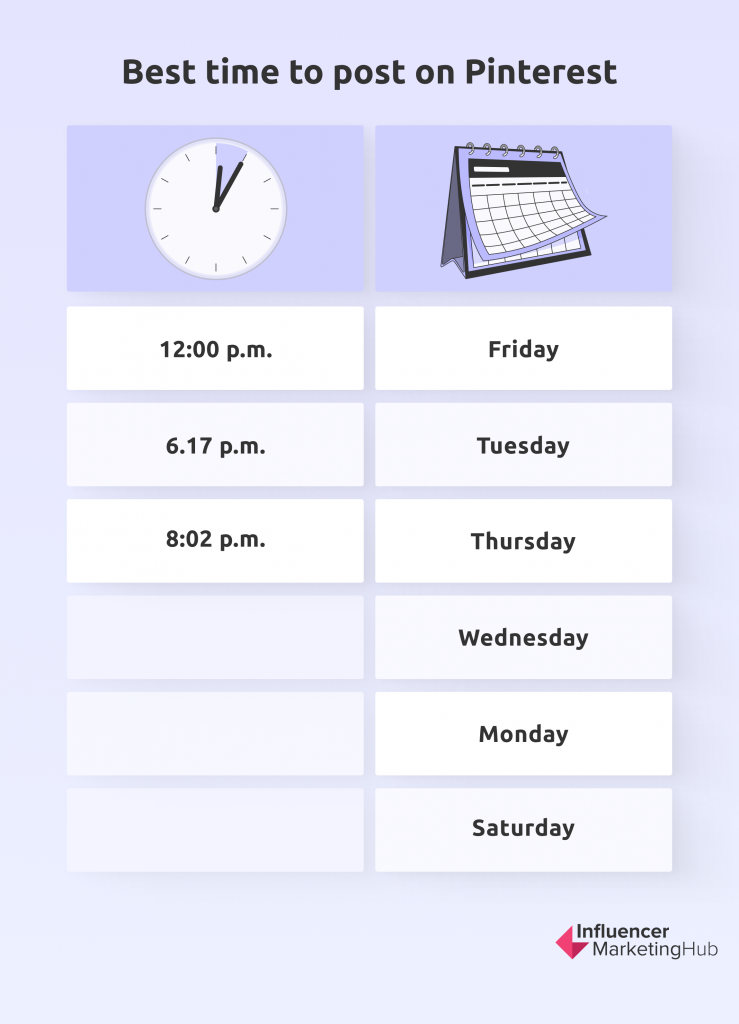

33 Mind Blowing Pinterest Stats For 2022

Warm Up Exercises Find The Slope Of The Line That Passes Through The Points 2 3 2 5 2 Answer 1 0 2 1 3 2 Answer Ppt Download

Til One Decade Ago Average Mcats At Top Medical Schools Were 32 34 Student Doctor Network

Act To Mcat Correspondence Logic Student Doctor Network

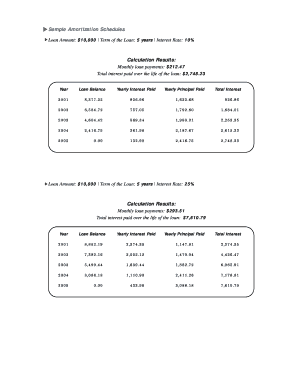

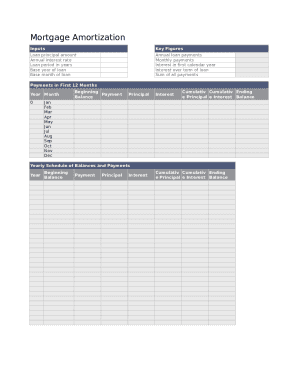

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

Kenny Idstein Loandepot

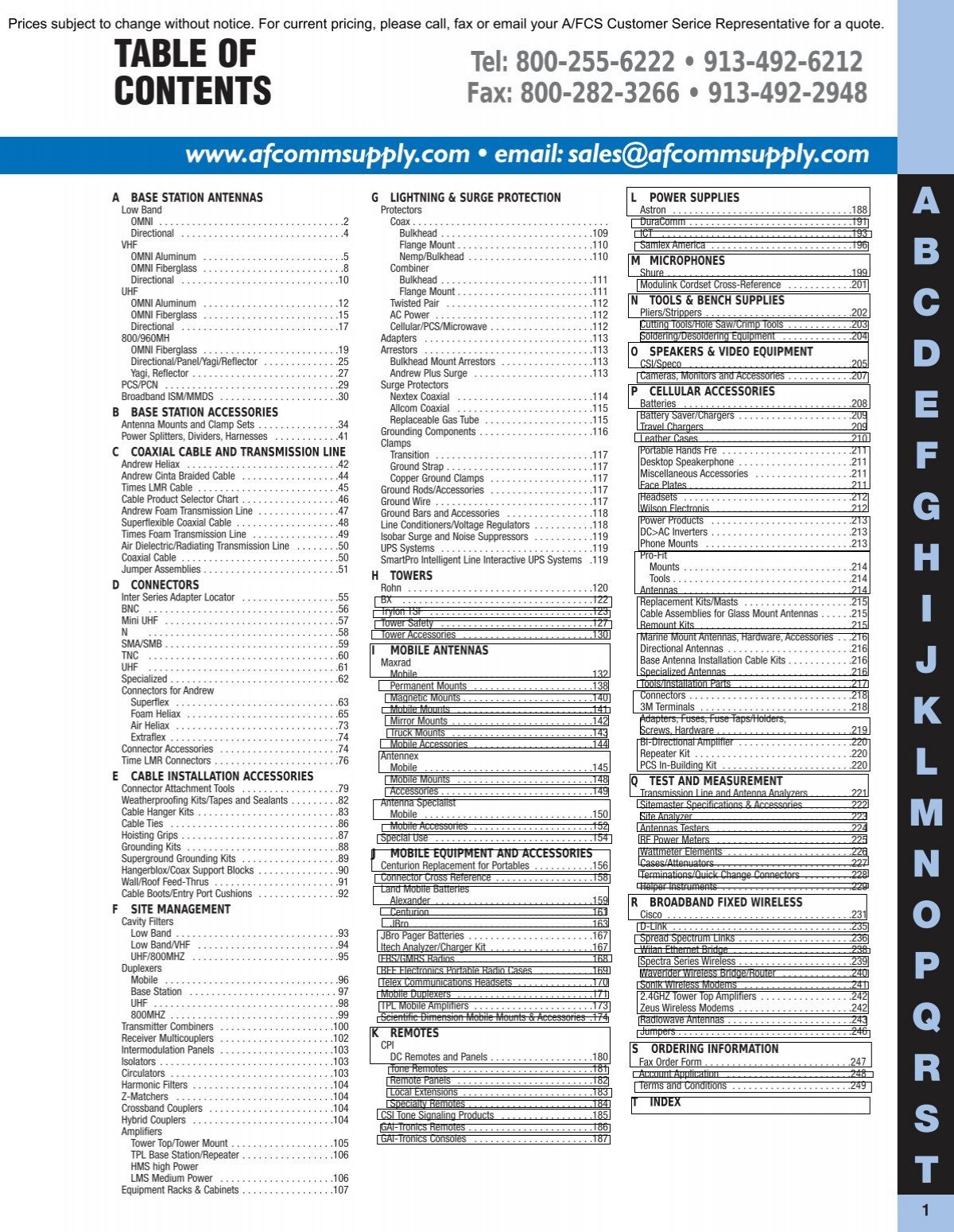

A Base Station 1 33

Composite Deck W Skirting And Black Railing Patio Deck Designs Decks Backyard Deck Designs Backyard

2

33 Free Finance Printables

Kenny Idstein Loandepot

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

Check Out This Behance Project Sign In Login Screens Https Www Behance Net Gallery 50803309 Sign In Login Screens Signs Screen Login

Top 9 Best Currency Converter Apis 2021 33 Reviewed

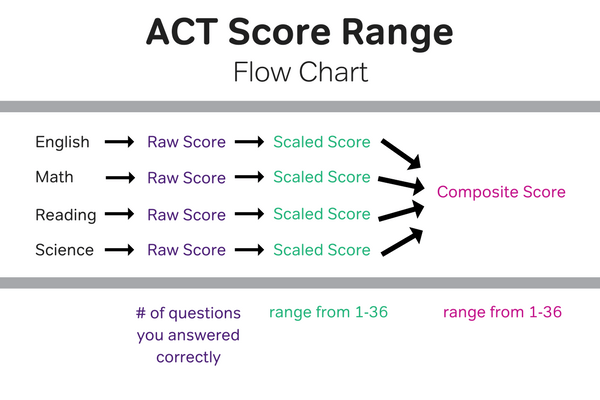

Act Scores Everything You Need To Know Magoosh Blog High School